U.S. stocks have generally gone up around the time of the Federal Reserve’s annual Jackson Hole Economic Policy Symposium. This week, investors will be paying close attention to the event, especially on Friday when Fed Chair Jerome Powell is set to give a speech.

In an email sent Monday, Nicholas Colas, co-founder of DataTrek, said, “The S&P 500 tends to rally over the two weeks on either side of the Fed’s Jackson Hole conference, with returns coming mostly after the Chair’s speech.” It looks like things will stay the same this year.

It will be held in Jackson Hole, Wyoming, from August 22nd to 24th. The Jackson Hole Economic Policy Symposium is a meeting of central bankers and experts. On Friday at 10 a.m. Eastern time, Powell is set to talk at the retreat.

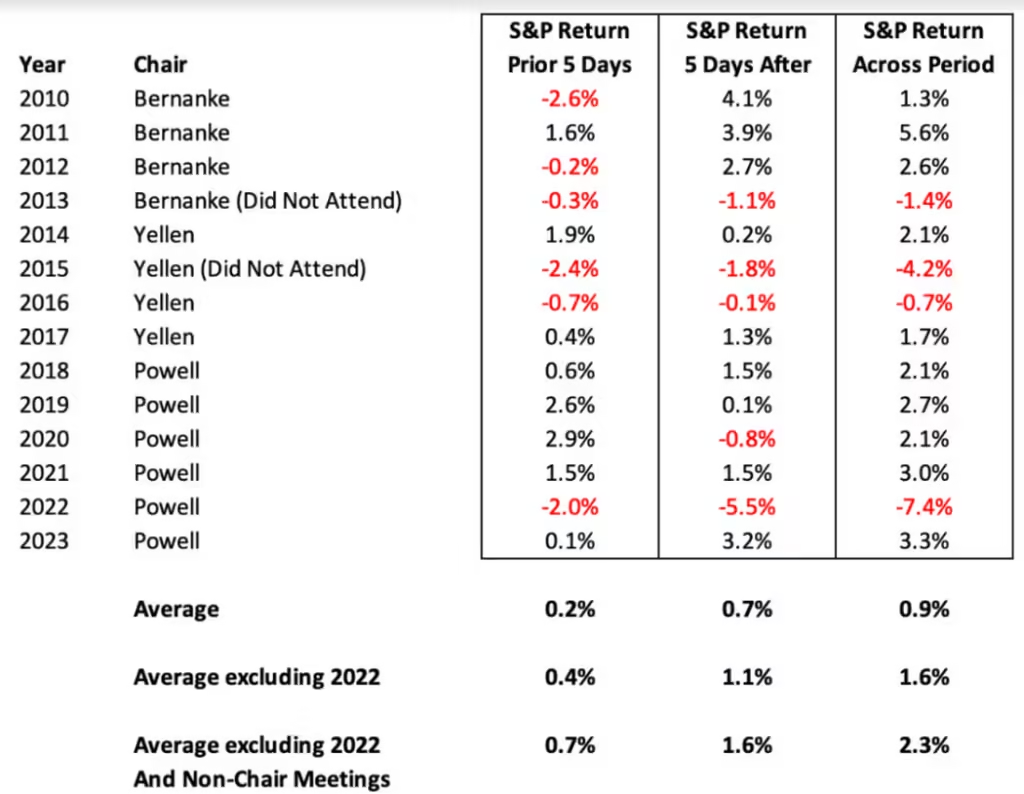

The S&P 500 index SPX -0.06%, which is a measure of big U.S. stocks, has had an average return of 0.9% over the two weeks around Jackson Hole since 2010. As shown in the table below, Colas said, “Fed Chairs don’t always show up, and we have kept track of those years.”

In 2022, the S&P 500 dropped a lot around the time of Jackson Hole. According to DataTrek, this was “an outlier year given the Fed’s aggressive monetary policy”—a series of interest rate hikes meant to bring down high inflation.

Colas says Powell’s speech in Jackson Hole in 2022 “surprised markets” because it showed the Fed would do anything to bring down inflation. Powell also said at the time that higher rates would likely cause “some pain to households and businesses” because the Fed would likely slow growth and make the job market weaker.

Now, investors are expecting the Fed to lower interest rates because inflation has dropped a lot and worries about the economy have grown since the U.S. job market recently slowed down.

Colas said, “The market thinks that the Fed will cut rates later this year.” “Powell should be able to calm people down enough about the issue this Friday for the normal ‘Jackson Hole Drift’ to go up over the next two weeks.”

Last week, the S&P 500 had a strong rise. According to Dow Jones Market Data, it ended the week 2% below its record high set on July 16. After a selloff caused by worries about a worse-than-expected jobs report earlier this month, the U.S. stock market went up again.

Before Powell’s much-anticipated speech in Jackson Hole, Colas said, “he knows that markets are coming off of a volatile few weeks and will want to choose his words carefully.”

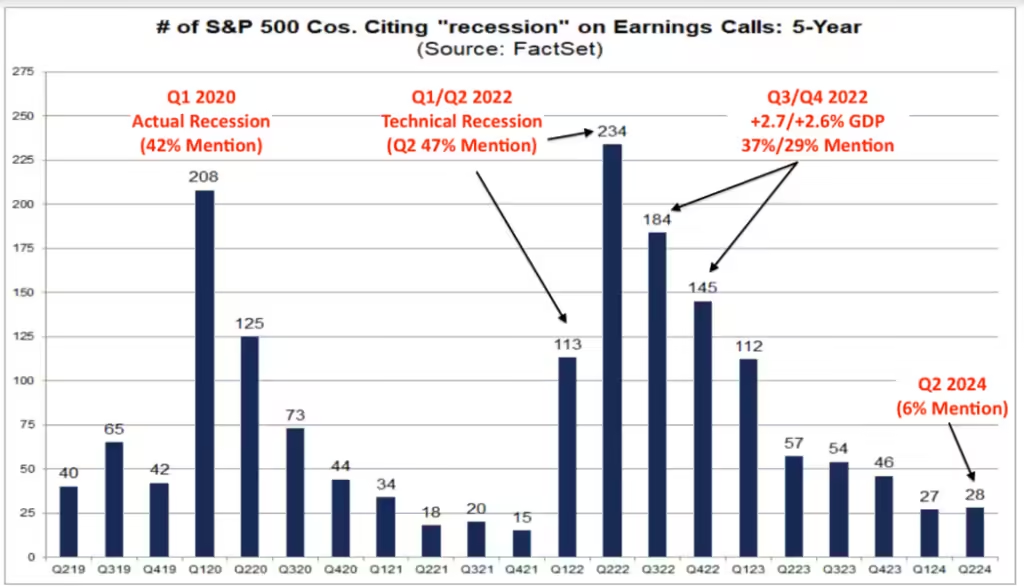

Another thing that DataTrek says is that companies don’t seem too afraid about a recession happening soon based on their most recent earnings calls.

Colas said that the fact that only 6% of S&P 500 companies talked about “recession” in calls with investors and analysts about their second-quarter earnings reports was “quite low.”

“That is not so much an economic observation as it is a sign that corporate managers are still confident in their companies’ ability to make money in the near future,” Colas said. “If there was any reason to explain either missing earnings or giving less clear guidance for the future, it would be that a recession is just around the corner.”

In the first quarter of 2020, during the “pandemic recession,” 42% of S&P 500 companies used the word “recession” in their investor calls. This is according to the DataTrek note, which used data from FactSet to make the chart below.

The DataTrek note shows that the word “recession” was used 47% of the time in the second quarter of 2022, when the U.S. was in a “technical recession” and its GDP was “negative” for two quarters in a row.

According to Colas, these kinds of mentions stayed high for the rest of 2022, even though the U.S. economy was “clearly not experiencing” a recession as defined by the National Bureau of Economic Research. He said that a recession is “a big drop in economic activity that lasts longer than a few months and affects the whole economy.”

“Recession” was used as an excuse by the managers of S&P 500 companies, according to Colas, when they had to compare their earnings in 2022 to those in 2021.

An important report from S&P Global’s purchasing managers’ index on the U.S. industry and services sectors this month will be shown to investors on Thursday. On the same day, weekly figures on the first jobless claims in the U.S. will be made public.

Colas said that the initial claims report from last Thursday “reassured markets that U.S. labor demand remains OK.” This means that Powell can “lean into a confident message about the American economy.”

The S&P 500, the Dow Jones Industrial Average DJIA -0.18%, and the tech-heavy Nasdaq Composite COMP -0.20% were all going up on Monday afternoon. The last time we checked, FactSet data showed that they were all up about 0.6%. The market’s rise made the S&P 500’s year-to-date gain about 17%.