It’s possible that President Donald Trump has just lost a crucial tool to help him get his expansive tax and spending plan approved by Congress: the assurance that tariffs will generate hundreds of millions of dollars.

With slim majorities in both chambers of Congress, the White House is relying on every Republican to support Trump’s megabill, which would double the state and local tax deduction, increase funds for border security, and prolong the tax cuts from 2017. Additionally, the Congressional Budget Office estimates that it would raise the federal budget deficit. Fiscal hawks are uneasy about that.

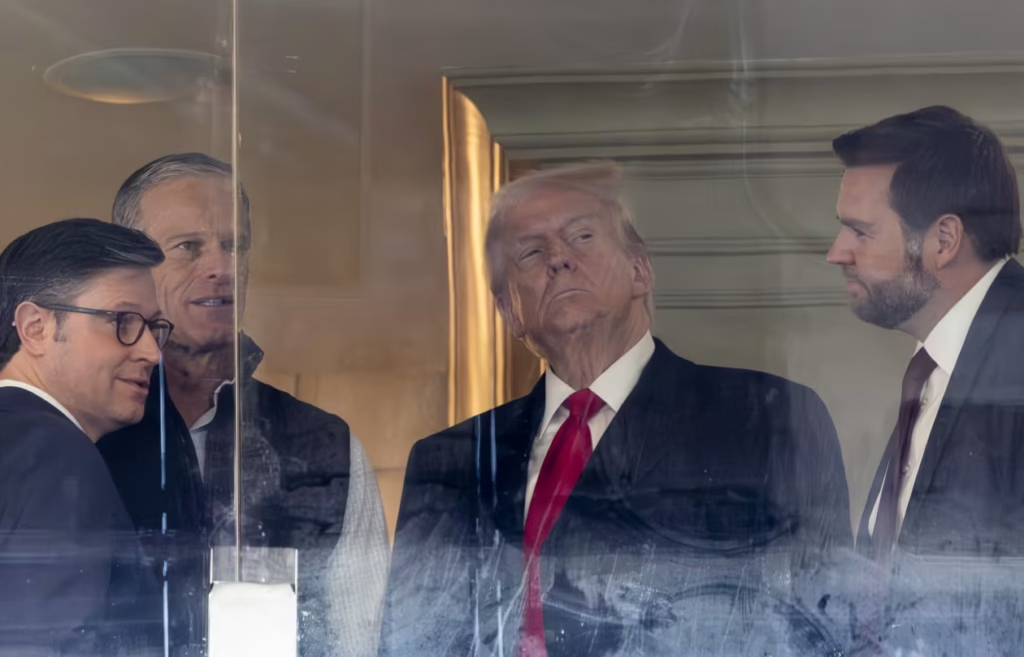

The bill, known as the One Big Beautiful Bill Act, excludes tariff revenue. Trump has nevertheless continued to highlight the money that his tariffs are bringing into the federal coffers. For instance, Trump claimed to have contacted Senate Majority Leader John Thune and House Speaker Mike Johnson earlier this month to inform them of “hundreds of millions of dollars of tariff money coming in,” in addition to the savings from unilateral action on medication pricing.

Now, some of Trump’s talking points have been turned upside down by the Court of International Trade’s decision on Wednesday. The court decided that Trump went too far by citing a 1977 law that makes no mention of tariffs, ruling in favor of a collection of small firms and states with Democratic majorities.

A federal court temporarily reinstated Trump’s tariffs late Thursday after the White House appealed the court’s decision. Analysts predict that the case may reach the Supreme Court, though it is unknown how long an appeal will be heard.

“First, we’re going to see what happens on appeal, and we’re very confident in our success there,” Kevin Hassett, the director of the National Economic Council, stated on Fox Business Network Thursday morning. Hassett added that, aside from the duties that were prohibited, there are other ways to approach trade.

However, if the trade court’s decision is upheld, UBS estimates that billions of dollars in lost revenue would result.

“The administration had hoped to rely on tariff income to lessen the deficitimpact of the ‘One Big Beautiful Bill’ Act even if it wasn’t going to beofficially scored in the legislation,” UBS analysts wrote in a note on Thursday.

“If the CIT’s decision is upheld on appeal, the anticipated tariff collection will be decreased. We calculated that the U.S. effective tariff rate was approximately 15% prior to the verdict, which might have brought in $300–450 billion annually. According to UBS, the ruling will lower revenue to less than $200 billion by lowering the effective tariff rate to 6%.

Furthermore, if the court’s decision is upheld, the United States might be required to return tariff funds that have already been collected. ING estimates that approximately $8 billion of the nearly $14 billion in tariffs collected through April 30 may have been paid on goods imported from China and Hong Kong.

Trump’s megabill was approved by the House of Representatives on May 22 and will be considered by the Senate the following week. Sen. Ron Johnson of Wisconsin is opposed to the measure, so Trump and GOP leaders will need to win him over.

These independent researchers estimate it to be between $3.3 trillion and $4 trillion. “I concur,” Johnson stated on CNN. “We must lower the deficit. Therefore, we must concentrate on spending money.