What kind of weather is it today? To respond to this question, you don’t have to be a meteorologist. Simply glance out the window. For macroeconomists, this luxury is not available. It will take till the end of July to release the first official GDP estimate for this quarter. Actually, we still don’t know the GDP for the previous quarter! We are drowning in statistics on every facet of the economy, including employment, production, sales, inventory, and more, while we wait for these vital figures. Economists at trading desks, central banks, and the media rely on processing this data to determine whether the economy is experiencing rain or sunshine. Fortunately, recent developments in statistical and computational techniques have produced automatic real-time solutions to this difficult big data challenge, using a technique known as “nowcasting.” This article explains how the FRBNY Nowcast is produced at the New York Fed using these methods and what we may learn from it. Additionally, it introduces our Nowcasting Report, which we will begin updating on our website every week on Friday, April 15.

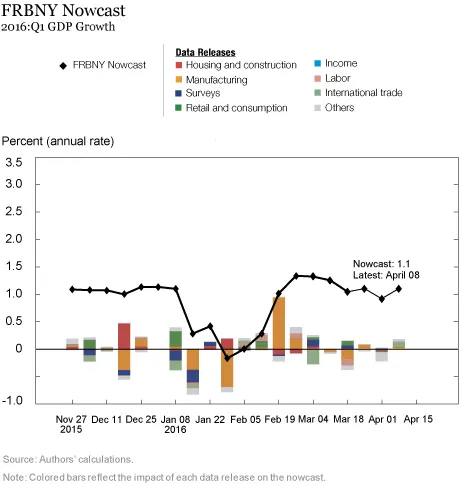

The primary visual aid we developed to monitor the FRBNY Nowcast’s development in real time as macroeconomic news is recorded is the chart below. Based on data available at the dates shown on the x-axis, our best estimate of GDP growth for the first quarter is shown by the black line with diamonds. The last diamond, for example, states that, according to data disclosed up to last Friday, the nowcast for GDP growth in the first quarter was 1.1 percent. When we began tracking the current quarter on November 27, 2015, the first diamond in the series was our estimate of the same first-quarter GDP growth. The weighted average impact of the news received over the week is represented by the nowcast revision, which is the difference between two successive nowcasts. The colorful bars show how the news has affected the nowcast; news from specific industries is reflected by a distinct hue. For example, the light green bar in the image indicates that the news from foreign trade statistics helped to improve the nowcast last week, raising it by roughly 0.1 percentage points.

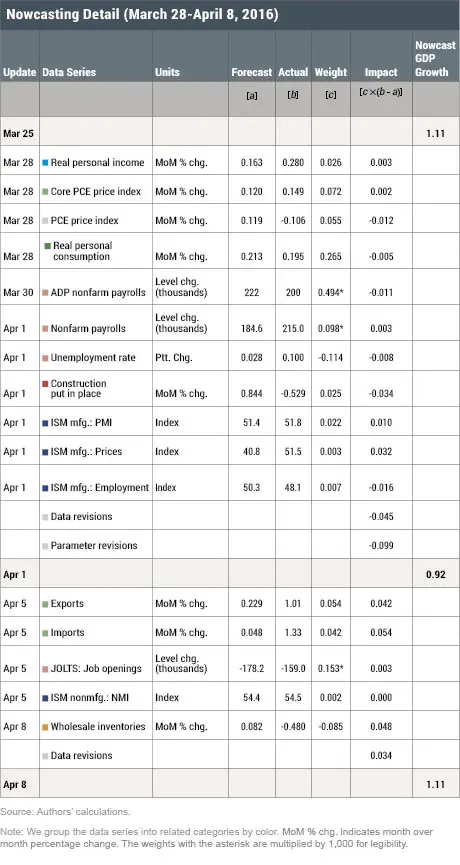

Though the chart above presents information at a weekly frequency, we update and monitor the FRBNY Nowcast on a daily basis, as soon as new data are released. The real-time updates for last week’s releases are reported in the table below. A more detailed version of this table, including a longer history of recent releases, is available in the Nowcasting Report. The table’s columns decompose the steps involved to parse the impact of each data release on the nowcast. These steps are performed by a statistical model that distills the intricate relationships among different data series into a small number of so-called factors, which summarize the underlying “state” of the economy. The model computes a forecast for each release, denoted by a. The difference between the actual release (b) and this forecast is the news (that is, b − a) contained in the release, the new piece of information revealed by the data. Finally, the news is combined with a weight (c), which captures the timeliness and quality of each piece of new information, to give us the impact (c × (b − a)) of the release on the nowcast. For example, the “All employees: Total nonfarm” payroll print for March of 215,000 jobs, which was released at 8:30 a.m. on April 1, represented positive news compared with the model’s expectation of 184,600 new jobs, yielding a surprise gain of 30,400 jobs. Given the weight (of 0.098/1,000) attributed to employment news by the model, this surprise translated into a positive impact on the nowcast of 0.003 percentage point.

But how trustworthy is the FRBNY Nowcast’s underlying model? We direct you to the numerous scholarly investigations that have been carried out on the topic for a comprehensive response to this significant query. All things considered, their research indicates that nowcasting methods yield outcomes that are on par with, and frequently more accurate than, those of the most skilled human forecasters, with the extra benefit of being automated and judgment-free. Nowcasting is not always accurate because of this. Even the official GDP release undergoes two revisions before it is deemed “final,” demonstrating the substantial amount of noise in macroeconomic data. As a result, just like other forecasts made by economists, the nowcast is inaccurate in any particular quarter.

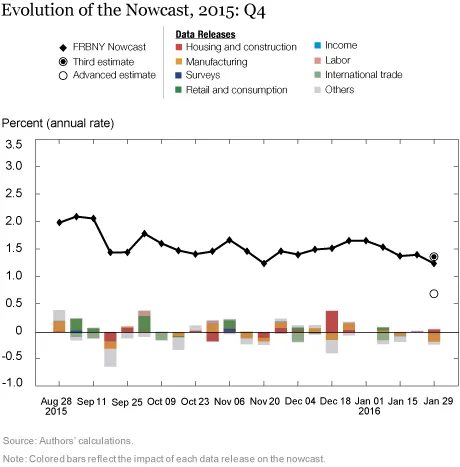

For example, the following figure shows the progress of the nowcast for 2015:Q4, a quarter for which the third GDP estimate is already available. Together with the first, or preliminary, estimate (the empty dot), this estimate is shown in the chart as a full dot.

By the time the first release became available, the nowcast predicted a growth rate for GDP of 1.2 percent, which is very close to the latest available number. Of course, this is only one example. However, the more comprehensive studies mentioned above demonstrate the usefulness of statistical nowcasts as a way of translating the real-time data flow into an estimate for current GDP. This reliability makes nowcasts a fundamental instrument in policymakers’ toolbox, especially in this era of data-dependent monetary policy.