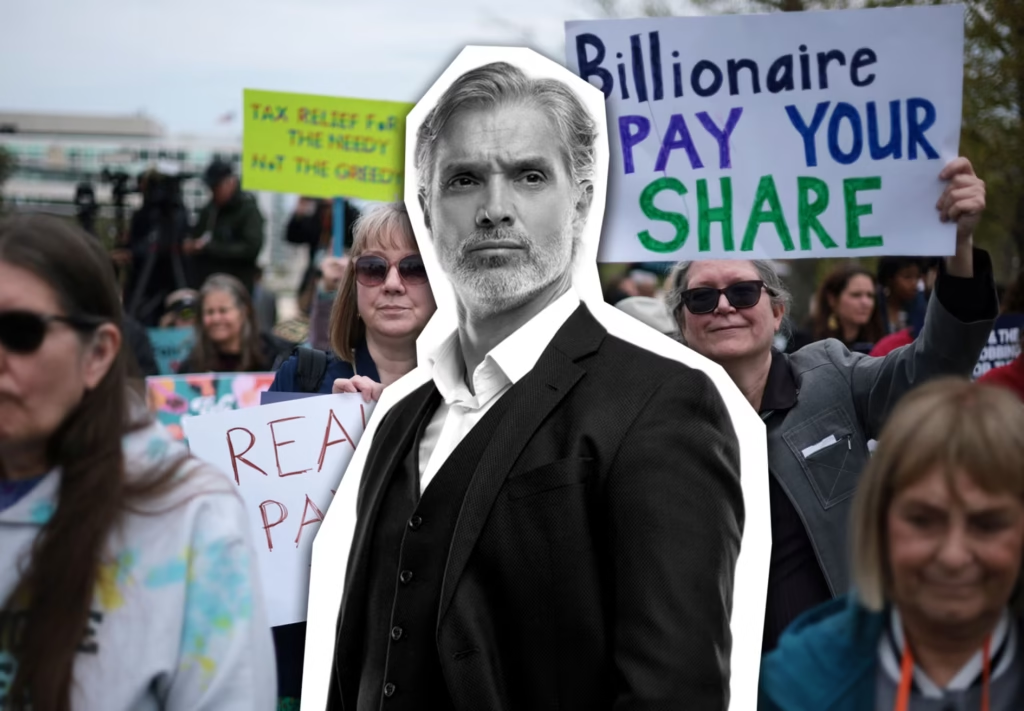

California and other Democratic-leaning states are leading the way in possible tax increases on extremely wealthy Americans. What follows?

The topic of how much more taxes America’s ultra-wealthy should pay has come up again in the new year.

In 2026, persistent questions in the tax-the-rich debate may finally receive better answers, but the battle for higher taxes for the 1% is not new.

Jared Walczak, a senior fellow at the Tax Foundation, stated, “I believe that 2026 has the potential to be a very significant year for wealth taxes, simply because we’re going to learn something.”

These responses can include: Will Americans truly vote to impose greater taxes on the wealthy when they advocate for them to pay higher taxes? To what extent do extremely wealthy individuals find high taxes unsettling, and how far will they go to avoid them? Is wealth genuinely taxable, as opposed to income?

Where will the answers to these questions be found? To begin, head west.

A California ballot issue that would levy a one-time 5% tax on residents worth at least $1 billion begins gathering signatures this month. The ballot proposition would allocate the majority of the funds to the state’s Medicaid program. The remainder would go to state programs for food aid and education.

According to rumors, some well-known millionaires have already begun to leave, including Larry Page, a co-founder of Google (GOOGL) (GOOG). However, Jensen Huang, the CEO of Nvidia (NVDA), has stated that he is “perfectly fine” with the levy.

Although California is the focal point of the discussion, it is not the only state. The Democrat governor of Washington state, Bob Ferguson, is in favor of raising the income tax on millionaires.

Democratic socialist Zohran Mamdani, the recently elected mayor of New York City, has reaffirmed his demand for greater income taxes on the city’s rich in order to fund universal daycare. To make his tax increase a reality, however, he will require the backing of state lawmakers.

Additionally, it has been claimed that Democrat Dan McKee, the governor of Rhode Island, is considering raising taxes on millionaires.

A vote in November is being considered in Michigan to impose an additional 5% tax on married couples with taxable incomes of at least $1 million, or $500,000 for individuals. The state’s educational system would receive the funds.

Gavin Newsom, the governor of California and a possible candidate for the Democratic Party’s 2028 presidential candidacy, has stated that he opposes the proposed ballot proposal in his state. President Donald Trump won Michigan in the 2024 presidential election. However, the 2026 crop of tax-the-rich initiatives is developing in states that lean Democratic.

In contrast, eight Republican-leaning states lowered their income tax rates for all citizens in 2026, while Ohio switched to a flat tax. In the 2024 election, Trump won all of them.

It is no accident that the new suggestions come after the significant federal tax law passed last summer.

Republicans claim that while the One Big Beautiful Bill Act’s tax incentives are aimed at middle-class and working-class people, high-income households will gain the most. As an illustration, the same rule also kept tax rates from rising, keeping the top rate at 37%. It kept the estate tax permanently higher and increased the generosity of tax credits for companies.

“All of those income-tax rates and the better estate-tax structure have all been extended permanently,” stated LPL Financial executive vice president of asset planning Tara Thompson Popernik. “Now at the state level, legislatures are looking to raise additional revenue because those same taxpayers did not get hit at the federal level last year.”

Medicaid, a combined federal and state program that provides health insurance to low-income households, is also receiving less funds and more stringent regulations as a result of the large federal law. Darien Shanske, a professor at the UC Davis School of Law who contributed to the tax text for the California ballot proposition, stated, “This ballot measure is responding to that enormous, needless, stupid, and cruel crisis.”

The increasing number of state plans targeting the top of the tax code does not surprise Shanske. “Similar pressures are creating similar solutions,” he stated.

To what extent do voters really want wealthy individuals to pay higher taxes?

People generally believe that the tax code is unfair, according to polls. Most recently, a YouGov survey this month found that 62% of respondents said billionaires pay too little in taxes.

This sentiment is strongly held among Democrats, and a significant portion of Republicans also share it. According to the survey, 32% of Republicans believed billionaires were taxed fairly, while 39% said their taxes were too low.

Does conversation result in action? A person’s actions at the voting booth may not match what they tell pollsters.

According to Carl Davis, research director at the left-leaning Institute on Taxation and Economic Policy, state governments are dealing with reduced budgets while many consumers are struggling with affordability issues. He continued, “The stock markets DJIA SPX COMP continue to break records at the same time, enriching the portfolios of wealthy Americans.”

“It’s not like flipping a switch, but I think the conversation is shifting,” Davis stated. “There are a lot of reasons to suspect there will be more political will in 2026 and the years to come.”

For a brief period last spring, Trump allegedly suggested raising the top income-tax level for those earning at least $2.5 million to 39.6%. This would have raised their taxes and gone against the Republican Party’s aversion to higher taxes.

Although that didn’t occur, Davis pointed out that it was telling. “The fact that it was even entertained, I think, shows it is not purely partisan and there is a recognition of a national mood of people being frustrated with what they see as the two-tiered economy,” he stated.

An recurrent concern in recent years has been the possibility of rising state taxes for wealthy taxpayers. For instance, taxes on the wealthiest citizens of Maryland and Minnesota have increased recently.

Voters in Massachusetts adopted a 4% surtax on households earning $1 million or more in 2022. A ballot issue that would have imposed an additional 1.75% tax on households earning at least $2 million was defeated by Californians in the same year.

“Voters’ desire to tax others is sometimes overestimated,” stated Walczak of the Tax Foundation. What about 2026? “We’ll see,” he informed me.

Will billionaires and millionaires increase their stakes in order to evade wealth taxes?

Super-rich residents of California as of January 1, 2026, would be subject to the California Billionaire Tax Act.

Action appears to be prompted by that deadline: Peter Thiel’s private investment company, Thiel Capital, said on the last day of 2025 that it had built an office in Miami to supplement its Los Angeles activities. “Mr. Thiel has established a significant presence in Miami over the last several years, maintaining a personal residence in the city since 2020,” according to the company’s news release.

Prominent lawyer Alex Spiro urged Newsom to oppose the California tax, claiming it would “trigger an exodus of capital and innovation,” in a letter. “Our clients have made clear they will permanently relocate if subjected to this tax,” he stated.

Will affluent individuals actually band together to evade a tax bill? Or is the possibility more anecdotal than systemic?

Popernik of LPL is currently reviewing the suggestions, but nobody is packing their home. According to her, pulling up stakes is a major thing, and it could take a lot of work to persuade state tax officials that a person has permanently left and is no longer liable for state taxes.

Popernik does observe business owners relocating to tax-friendly areas years in advance of significant transactions, such as a windfall-producing sale. However, in general, it’s a more difficult choice if lifestyle, climate, and closeness to friends and family are important considerations.

“A few of your clients will make slightly more tax-driven decisions. But generally speaking, the heart is at home,” she remarked. It is especially true for wealthy families, “who have the privilege of choosing where to settle and spend their time.”

The impact of taxes on where people choose to live has been the subject of conflicting studies. The Fiscal Policy Institute, a leftist research organization, examined state tax statistics prior to Mamdani’s overwhelming win. Researchers reported that “New York’s top 1% of earners move out of the state at the lowest rate of all income groups” on a “consistent” basis. That was even after New Yorkers earning at least $1 million were subject to an increase in income tax in 2021.

However, according to a 2019 study, billionaires have a tendency to leave states that impose inheritance taxes, particularly as they get older.

U-Haul announced this week that the top two states for one-way U-Haul relocation in 2025 were Florida and Texas. There is no income tax in any state. For the sixth consecutive year, California had the highest number of do-it-yourself migrants.

Walczak pointed out that ultrahigh-net-worth households probably don’t load their own U-Haul vans. However, he added, it highlights a more significant point: People may leave states like the Golden State due to high expenses, especially taxes. “All these things run together.”

Is wealth even subject to taxes?

increased income taxes would make up the majority of the current state proposals for increased taxes.

The California plan, on the other hand, would tax a person’s whole net worth, including assets that have increased in value but haven’t been “realized.”

“There has never been a wealth tax. “Your investment has never been subject to an asset tax,” Walczak stated. “This would be entirely new in the United States and it would be extremely rare globally.”