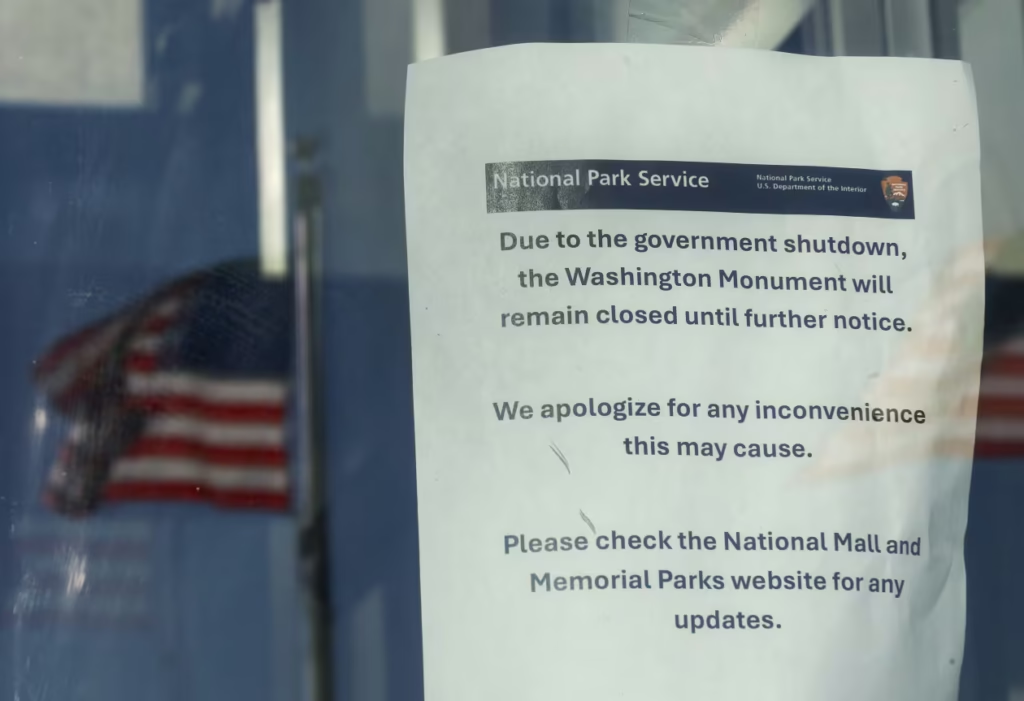

Due to the government shutdown, the Washington Monument in Washington, D.C., was closed on Wednesday, according to a sign posted there.

Even though it’s difficult to predict the economic impact of a U.S. government shutdown, economists nevertheless put on their thinking caps and try.

What is their opinion, then?

Joe Brusuelas, chief economist at consulting company RSM US, estimates that the current shutdown will deduct 0.1% from U.S. economic growth for every week it continues. In a message on Wednesday, he stated that this estimate is based on the assumption that federal employees will receive their back pay as they often do when agencies reopen and is valid for a closure that is on the shorter side.

Subtraction of that magnitude would be minimal. According to an estimate last week, the U.S. gross domestic product climbed 3.8% in the second quarter.

According to other analysts, a shutdown would reduce the nation’s GDP by 0.1% every week. Indeed, when a 35-day closure started in December 2018 during President Donald Trump’s first term, White House officials provided that estimate.

However, the Trump White House’s Office of Management and Budget has hinted that agencies may seek mass layoffs, which might make this shutdown unique. Federal workers who weren’t deemed vital would be placed on furlough during previous shutdowns, but they weren’t threatened with layoffs.

Although the magnitude of potential mass layoffs is still unknown, observers are monitoring the situation.

Given that the Supreme Court recently reaffirmed a notice period of 30 to 60 days for federal mass layoffs, Evercore ISI analysts predicted that the Trump administration would likely attempt to use the threat of layoffs to pressure Democrats in negotiations to end the shutdown. However, any attempt to implement immediate layoffs would likely result in litigation and confusion. “Moreover, most agency shutdown plans released so far have pointed to the normal furlough process rather than layoffs, confirming our view that many Cabinet Secretaries are wary of further job cuts,” the Evercore team stated in a note.

According to several published sources, Russ Vought, the director of the Office of Management and Budget, informed House Republicans on a call Wednesday afternoon that layoffs, also known as reductions in force, or RIFs, would begin in a day or two and would have a significant impact.

A Congressional Budget Office assessment released Tuesday suggested that 750,000 government workers might be placed on furlough each day. “The number of furloughed employees could vary by the day because some agencies might furlough more employees the longer a shutdown persists and others might recall some initially furloughed employees,” according to the CBO.

The impartial U.S. agency estimated that their compensation would cost almost $400 million every day.

The Committee for a Responsible Federal Budget, a nonpartisan monitoring group, has highlighted that federal contractors have not historically been compensated for lost wages following a shutdown. Therefore, those missed paychecks are likely to have a negative impact on households with a government contractor as well as the local businesses that depend on their spending.

From the January 2019 MarketWatch archives: During the shutdown, this furloughed employee discovered a novel way to earn $2,000 a month.

Democrats and Republicans are at odds over whether to include an extension for Obamacare subsidies in funding legislation, which is why the current shutdown started at 12:01 a.m. Eastern time on Wednesday.

According to analysts at Evercore, it is likely to be brief, lasting perhaps a week or two. “It will likely end when enough Democrats accede to a short-term funding bill that allows for healthcare negotiations and sets up another deadline later this fall,” they stated.

On Wednesday, prediction markets offered a similar assessment of the shutdown’s duration, with Polymarket predicting a 65% likelihood of a resolution before October 15 and Kalshi estimating it would last 12 days.

Putting closure worries aside, the S&P 500 index SPX closed at a record close Wednesday, extending its weekly gain to 1%. It is generally anticipated that the gauge, which has increased 14% so far this year, will continue to shrug off the shutdown.

“Because investors have been conditioned to the political theater around such brinksmanship, these shutdowns simply no longer hurt equity markets or move broader financial markets,” Brusuelas said.

However, independent economist Ethan Harris stated that he is “more worried than the markets,” citing the likelihood of a protracted shutdown and the potential for greater and longer-lasting economic harm.

In a note, Harris cautioned that the enmity between the two sides has significantly increased and neither will be willing to compromise. He added that the economy is now more susceptible than it was when the Trump administration’s so-called Department of Government Efficiency caused layoffs months ago, and that there is a significant difference between furloughing and terminating employees.

Former Bank of America and other bank analyst Harris stated that the current shutdown “could be the final straw for an already vulnerable economy.”