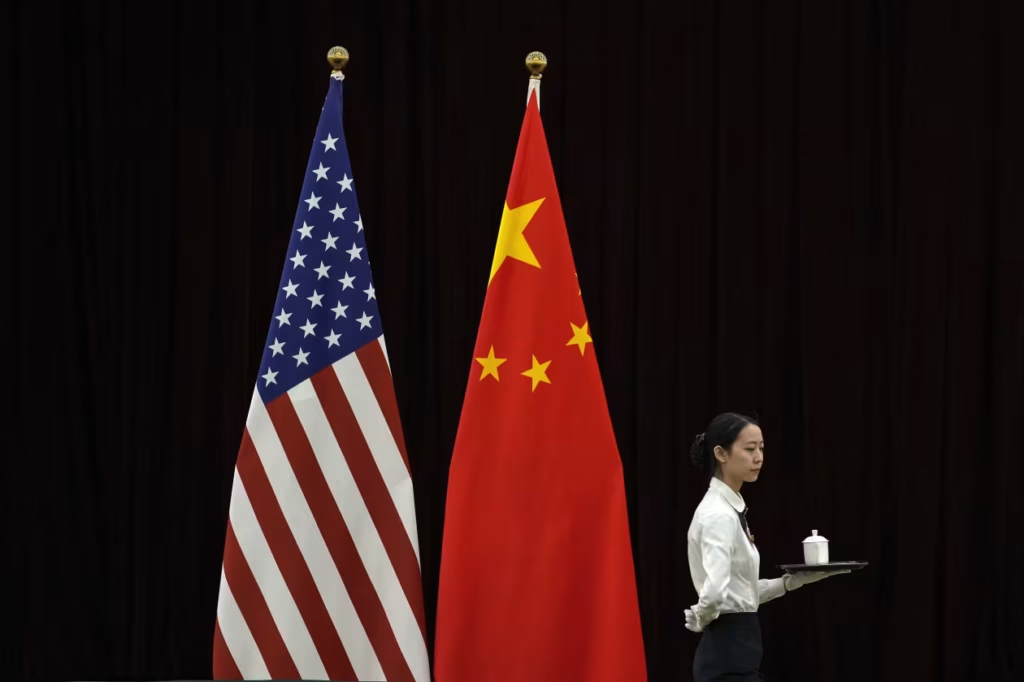

Many investors are on edge due to recent trade tensions between the United States and China.

Prior to last Friday, when a Truth Social post warning of a major tariff rise on Chinese products caused billions of dollars in stocks and cryptocurrency positions to disappear, investors appeared to have left President Donald Trump’s global trade war mostly behind them.

After a weekend update in which Trump reassured the public that there was no need for concern over China, financial markets were relatively calm again one session later. Additionally, there were some assurances from China: In a statement, the Ministry of Commerce clarified that licenses will be given for qualified applicants and that the export restrictions on rare-earth metals announced last week were not a total prohibition.

A group of policy analysts at Evercore ISI said the swift return to a de-escalatory stance demonstrates how economically intertwined the United States and China have grown. Investors should feel at least a little more at ease knowing that both governments seem to understand this. The temporary U.S.-China trade pact that helped boost global equities all summer appears to be in jeopardy once more, despite the fact that both countries’ reversals helped investors regain confidence in markets on Monday.

This implies that the financial markets’ outburst of volatility on Friday may not be the final one before the year ends. According to Ed Mills, a Washington policy analyst at Raymond James, China and the United States will use their favorite tactic—escalate to de-escalate—to test each other’s limitations on the path to a trade agreement.

“It’s a very high-stakes game of chicken involving the No. 1 and No. 2 economies in the world,” Mills said in an interview with MarketWatch.

Investors should keep an eye on Nov. 1, the new deadline set by the Trump administration for a long-term deal, Mills said. But he thinks the conversations might go on longer. “We have consistently referred to the trade and tariff dispute as a wild ride. “Trump punched a new ticket for the next round on Friday,” he continued.

Monday saw a surge in U.S. markets as Trump moderated his comments. The S&P 500 SPX and Nasdaq Composite COMP both concluded with their largest gains since May, while the Dow Jones Industrial Average DJIA had its best day in a month. Trump and Chinese President Xi Jinping are scheduled to meet at the Asia-Pacific Economic Cooperation meeting held by South Korea in late October, Treasury Secretary Scott Bessent said Fox Business earlier in the day.

The main stock-market indices in Asia also ended in a sea of red. The Shanghai Composite Index CN:SHCOMP dropped 0.2% and finished the day lower for the second day in a row, while Hong Kong’s Hang Seng HK:HSI closed down 1.5% for the sixth consecutive session of losses.

The most active contract, gold for December delivery (GCZ25), surged 3.2% to $4,128.30 an ounce amid indications that “not all is well with the world,” as strategist Thierry Wizman of Macquarie Group put it.

“Markets had been trading as if the tariff saga was largely resolved thanks to progress with the EU, Japan, and Korea – China being the conspicuous loose end,” Daniela Sabin Hathorn, a senior market analyst at Capital.com, an online trading platform, stated. There was a stampede of crowded longs when that assumption broke. For the time being, Monday’s attempts to partially retrace the gain are more in line with a classic positioning flush than a fundamental shift in the trend. The next course of action depends on whether the 100% tariff threat is immediately retracted or stays in place.

The “violent knee-jerk” market response that occurred on Friday “told us as much about positioning as it did about policy,” Hathorn wrote in a Monday email. “Valuations had become rich, momentum extended and volatility sellers comfortable.”

Even while U.S. markets largely bounced back from Friday’s trading session, investors may be as susceptible to more unfavorable trade reports in the future as they were before to Trump’s Truth Social post on Friday. Morgan Stanley equity strategists are now cautioning that if tensions do not de-escalate by early November, the S&P might be in for an unanticipated significant fall.

The Cboe Volatility Index VIX, a widely used indicator of stock market expectations for future volatility, fell from a high of 22.05 last Friday to as low as 18.61 on Monday. The indicator is down from the peak of tariff-driven anxiety in early April, when it hit its year-to-date high of 52.

It has been six months since the S&P 500 had a 3% daily decline on a selloff, according to Jim Reid, a researcher at Deutsche Bank, and “it’s unusual to go this long without one.” According to his remarks, investors might still be at risk in this regard.