The Supreme Court upheld a federal tax that made a couple from Washington pay for the gains they made on an investment even though they never made any money from it. The court said that the couple’s share in a foreign company had already been turned into taxable income.

Fans and opponents of the case wanted the Supreme Court to use it as an opportunity to decide if wealth taxes are legal or not, but the majority chose not to get involved.

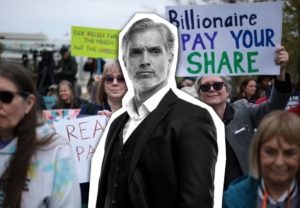

Still, some people who support a wealth tax saw that as a green light.

In fact, the 7-2 majority wouldn’t say anything clear about an even more important question: does income have to be “realized” (paid out in the real world) before it is taxed?

The majority opinion was written by Supreme Court Justice Brett Kavanaugh. He said, “We emphasize that our holding today is narrow.” The people who didn’t agree, led by Justice Clarence Thomas, said the court should have looked at the case the whole way through.

Moore v. United States was a case about how one part of Trump’s 2017 tax cuts changed how U.S. parent companies were taxed on their foreign earnings. It’s clear that a lot was at stake for the tax provision in question.

One estimate says that it would have cost the federal government $346 billion over 10 years to strike it down.

But some, like the lawyers for the Washington couple who were suing, said the case was also important because it could show if future wealth taxes that target the paper gains people make on their investments are constitutional.

A Billionaire’s Minimum Income Tax is what President Joe Biden wants to see happen. It would tax households worth at least $100 million at a rate of 25% and treat the rising value of capital assets that haven’t been sold as if they were stocks.

People who are very wealthy in this country need to pay more to do their “fair share,” Biden often says before elections in November.

“Nothing in this opinion should be taken to mean that Congress could try to tax both a business and its owners or partners on the same income that the business made but didn’t distribute,” Kavanaugh wrote.

Leila Carney of the law firm Caplin & Drysdale said that the fact that the court agreed to hear the case should be taken as a sign that it’s ready to step in again next time. The decision may not have gone into detail about wealth taxes.

“If I were in Congress, I’d say, ‘Okay, you told me how far I can go.'” He said, “I’m going to push this to the limit, but I know what will be too far.” She also said that the decision should serve as a warning to business owners about the power of Congress to tax their foreign investments.

Keith Thirion, vice president of strategy for Alliance for Justice, a legal advocacy group leaning to the left, says that wealth taxes are still possible after the decision.

“Ten percent of earners control two thirds of all wealth,” he said. “We need to look into ways to make sure everyone pays their fair share to build a society where we can all prosper.”

“It’s good to know that today’s narrow ruling doesn’t rule out any options, but we need to be careful how we respond to these clear attempts to give even more power to people who already have more than most of us can imagine.”

Charles and Kathleen Moore put $40,000 into a business that helped farmers in rural India. This was the start of the case. The Moores “never received any distributions, dividends or other payments” as the business grew and put money back into it, according to their lawyers.

The 2017 Tax Cuts and Jobs Act included the Mandatory Repatriation Tax, which was a one-time tax on earnings that were made outside of the United States and were now being brought back into the American tax system. They had to report more than $130,000 in business income for the Moores. The IRS charged the couple $14,729 in taxes.

In the first line of his dissent, Justice Clarence Thomas said, “The Moores paid $14,729 in taxes on an investment that never gave them a penny.”

Lawyers for the couple said that the tax on the earnings that had not yet been distributed was against the 16th Amendment, which is the constitutional basis for federal income taxes.

Because of the way capital gains taxes work, investments usually need to be sold or cashed out before taxes are due. Still, the federal tax code has times when taxes are due before the gain, and these times bring in a lot of money.

A study by the Tax Policy Center says that six tax rules that depend on unrealized gains are expected to bring in $87 billion this year.

The majority was worried that a decision in favor of the Moores could make other parts of the tax code less stable and “deprive the U.S. Government and the American people of trillions in lost tax revenue.”

Most people said that the Moores’ arguments would lead to cuts to national programs or higher taxes in many places to make up the difference.

“The Constitution does not call for that financial disaster,” it said.

The majority of the Supreme Court may have avoided going into too much detail about hypothetical wealth taxes, but Carney said that the real-world risk of losing tax revenue was very important.

“In this case, it was likely true that large parts of the tax code were in grave danger.” “I believe the court bought that and took it seriously, but they also knew they took on too much in this case,” Carney said.