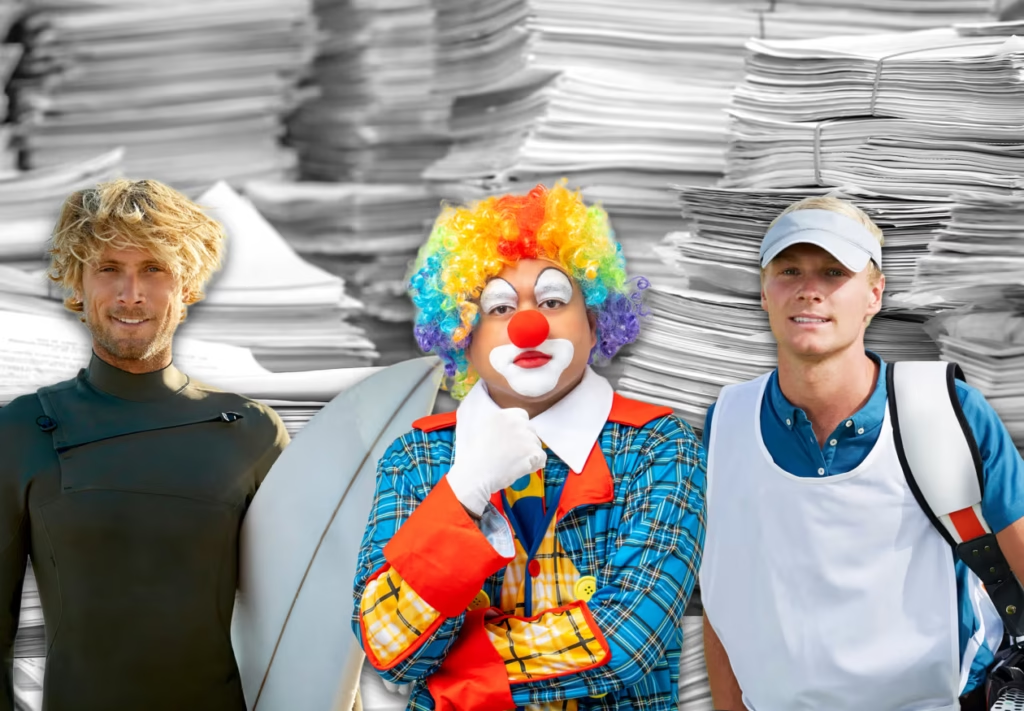

A preliminary list of professions eligible for “no tax on tips” suggests that tax authorities are examining broadly who is considered to be “customarily and regularly” receiving a tip. Clowns, golf caddies, surf instructors, and more are on the draft list.

Following the One Big Beautiful Bill Act, the Trump administration has hinted at who is eligible to receive the tax credit for tips. As a reminder, there are still significant questions to be addressed before employees can begin taking advantage of the tax reduction in the early months of next year. This is just one lengthy list thus far.

The deduction for tipped income was incorporated into the tax and spending package that President Donald Trump signed into law in July, after his campaign promise of “no tax on tips.” According to the law, the deduction would only be available for positions that “customarily and regularly received tips.”

It was unclear which jobs would be eligible for the tax benefit, which could be worth up to $25,000 to employees, at a time when more goods and services appear to contain a requested gratuity.

Tax authorities are looking broadly at who qualifies as “customarily and regularly” receiving a tip, according to a draft list of acceptable occupations.

Employees in the food service, gaming, and hotel industries appear to be eligible for the deduction. Other occupations on the preliminary list include cab drivers, landscapers, plumbers, handymen, and rideshare drivers, and that’s only the beginning.

The Treasury Department’s prospective list of positions eligible for the deduction was initially reported by Axios. MarketWatch received confirmation of the list from the Treasury Department.

The tip deduction is a component of a tax legislation that offers a number of specific tax benefits, such as deductions for senior citizen households, overtime pay, and auto loan interest for vehicles built in the United States.

Officials are attempting to provide specific examples, even though they are classifying qualifying employment under areas like “personal appearance & wellness” and “beverage & food service.” The list’s examples demonstrate how common tipping has grown.

“It’s a balancing act, but I imagine on balance, they would want to be more expansive than restrictive,” said Dave Kautter, a former Treasury Department official in the first Trump administration and an acting commissioner of the Internal Revenue Service.

For example, baristas and ice cream servers are qualified for the deduction because they are considered fast-food and counter-service employees. Those in the gambling sector who appear eager to win include pit clerks, casino dealers, and slot attendants. The draft list also includes clowns, magicians, street entertainers, wedding coordinators, pet groomers, yoga instructors, piano instructors, and golf caddies.

Likewise, so are producers of digital material, which encompasses influencers, podcasters, online video producers, and streamers.

A “club dancer” or a “dance artist,” for example, might also be eligible for the break. At least one accountant who works with adult entertainers said her clients were hoping they could benefit from the gratuity deduction, even if the style of dance isn’t specified.

According to Katherine Studley, owner of the Only Consultant and Prisma Tax Group, it makes logical for adult dancers to be on the list. Before you tip a Rockette, I believe you would tip a stripper. I don’t mean to offend either art form.

“My biggest question is whether strip clubs will follow the tax rules to report the tips to the dancers and the IRS,” she said, assuming Studley’s clients ultimately reach the final list.

The following steps for tipped employees to get their tax savings

The IRS has stated that Treasury and IRS officials have until early October to decide which employment will be eligible for the respite.

They still need to figure out how to count their tips and report them on their 2025 returns if they work in qualified jobs and do not earn more than the income caps under the provision. Individuals earning less than $150,000 and married couples earning less than $300,000 are eligible for the deduction.

See also: Will your taxes be reduced by Trump’s megabill? To find the answer, look at this number on your tax return.

The tax collector will require some documentation to support the claimed deduction, even if the individual is listed as having an acceptable occupation. What is the most effective method for tallying the tips?

Scott Klein, senior manager for tax policy and advocacy at the American Institute of CPAs, said the release of a list of qualified occupations ahead of the deadline of October 2 is great news. However, there is opportunity for clarification.

He stated that the IRS is attempting to alter its tax forms to assist individuals in claiming the tip deduction, adding that “what still remains unanswered includes how employers should report qualified tips separately from total allocated tips, and how to report an employee is working in a qualified profession” on the tax forms.

“Without clarity, taxpayers and employers alike will be uncertain how to report and claim the qualified tip deduction,” Klein stated.

According to Kautter, tax experts are still awaiting clarification from Treasury and IRS authorities regarding the reporting guidelines and procedures that tipped workers must follow on their 2025 forms.

Kautter, who is currently a partner at RSM, stated that although employers and their accountants are awaiting official regulations, there are still actions that people may take in the interim. He stated that this is particularly true if they work for themselves or as independent contractors.

“You would want to have books and records, if you are not an employee, that show the date that you worked and the amount of tips you received,” he stated. It always seems so official to say “books and records.” Many taxpayers only need to keep a written log of their activities, including the date, time, and amounts.

On July 4, Trump signed the bill into law. The first half of the year still needs to be taken into consideration, even if those in qualified positions began keeping track of their advice moving forward.

One strategy might be to maintain thorough records moving forward and then apply a fair approximation to the advice received during the first half of the year. According to him, that is predicated on the same pay rate and the absence of seasonal fluctuations in tips.

“It’s important to have something that backs up what you put on a tax return,” Kautter stated.

Which personal finance topics do you hope MarketWatch will cover? We want to know what readers think about their financial choices and inquiries. You can contact us by email at readerstories@marketwatch.com or by completing this form. To find out more, a reporter might get in contact. Without your consent, MarketWatch will not personally identify you based on your responses.