The atmosphere is different as developers, Wall Street analysts, investors, and media gather in Silicon Valley for Nvidia Corp.’s annual developer conference next week.

Early in the Trump administration, there has been a significant shift in the boom in artificial intelligence stocks. Numerous names, particularly Nvidia and other chip equities, have experienced a downdraft due to concerns about tariffs, a faltering economy, and possible data center overbuilding.

As a result of concerns over DeepSeek, a Chinese startup that claimed to have developed an AI model at a significantly lower cost than its American competitors, Nvidia’s (NVDA) stock has dropped 11% so far this year. In a single day, the January development reduced the semiconductor giant’s market capitalization by almost $600 billion, and shares have struggled to make a significant comeback.

However, Nvidia will take advantage of its enormous platform at the GTC conference to win over the ardent supporters and rekindle the enthusiasm of the tech sector over its development potential and its leadership in artificial intelligence. GPU Technology Conference, or GTC for short, refers to Nvidia’s main graphics processing units.

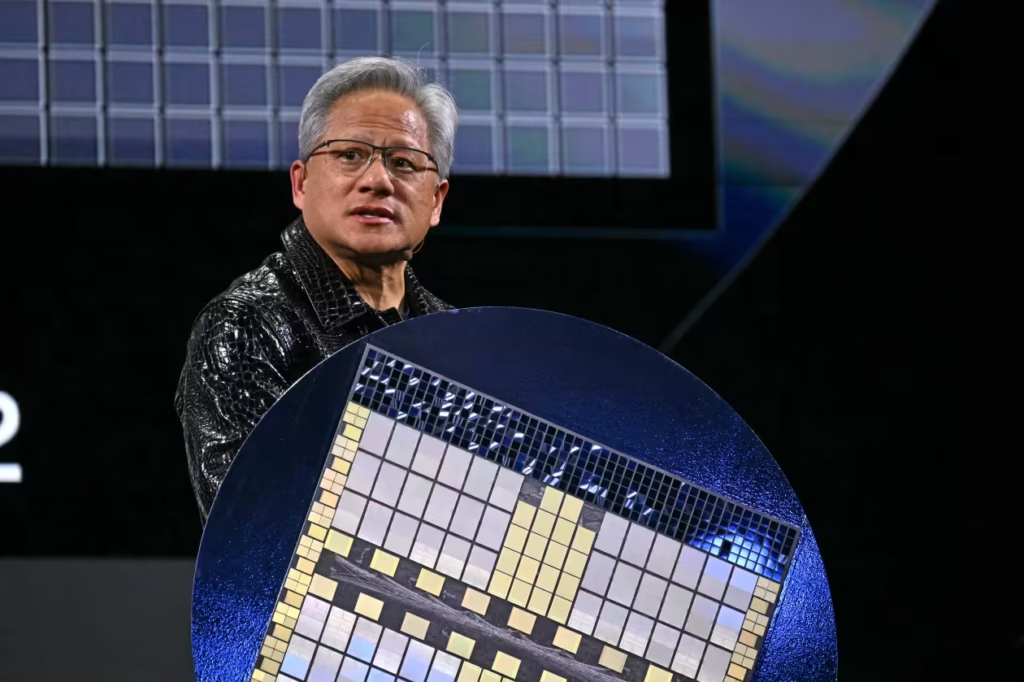

Similar to the late co-founder and CEO of Apple Inc. (AAPL), Steve Jobs, whose followers would faithfully attend MacWorld and listen to all he had to say, Nvidia CEO Jensen Huang has gained a lot of respect in Silicon Valley and even dons his company’s characteristic outfit, which in this case is a black leather jacket.

The business will undoubtedly talk about Huang’s vision for AI and robotics as well as a number of upcoming goods. He’ll probably discuss the company’s current Blackwell platform’s feeds and speeds as well as the upcoming Blackwell Ultra range. Investors, meanwhile, will also want guarantees that Nvidia’s next product line, code-named Rubin, will launch more smoothly than Blackwell.

Stacy Rasgon, an analyst at Bernstein Research, stated in a note to clients, “It is evident that the Blackwell introduction has not gone as smoothly as the company might have hoped, and there remains additional volatility given how laser-focused investors are on this supply chain.” “However, it does seem they have worked through things.”

During Huang’s Tuesday lecture, Nvidia is expected to highlight some of the capabilities of its most sophisticated Blackwell systems and discuss how much more sophisticated Rubin—named after American astronomer Vera Rubin—will be. The surrounding aspects, such its developments in high-speed optical networking and water-cooling alternatives, will probably also be discussed. As he did last year, Huang might also disclose the names of some of Nvidia’s largest partners or bring them onstage, which would cause those stocks to rise.

“It will be a victory lap of Blackwell and who is shipping it and who is using it,” stated Pat Moorhead, Moor Insights & Strategies’ lead analyst. “We will see more technical details on Rubin architecturally, not just the chip but also the rack [that the chips comes in].”

With the possibility of some improvements, he anticipates that a large portion of the presentation will be relatively repetitive of what Huang covered in his January keynote at the Consumer Electronics Show. Huang described Nvidia’s major initiative at CES to develop Cosmos, a robotics software platform designed to further the development of tangible AI systems like robots and driverless cars. In order to increase productivity, he also discussed agentic AI and the development of personalized AI agents.

Huang is known for his in-depth discussions of science and technology, but investors will also be watching for any signs that the surge in AI data center construction is slowing down. Some investors worry that a downturn in the economy brought on by tariffs may limit GPU spending.

However, it seems unlikely that these hints will be revealed during Huang’s keynote or even during the planned press and analyst Q&A sessions. Throughout the conference, many people will be listening for any conversations from Nvidia developers or customers, as well as any indications they may have from them. During its latest earnings call, Nvidia stated that it is unable to match the current demand for Blackwell systems.

“I think a bigger question for investors is along the lines of, ‘What are some of the things that could slow down the AI train?'” Moorhead stated.