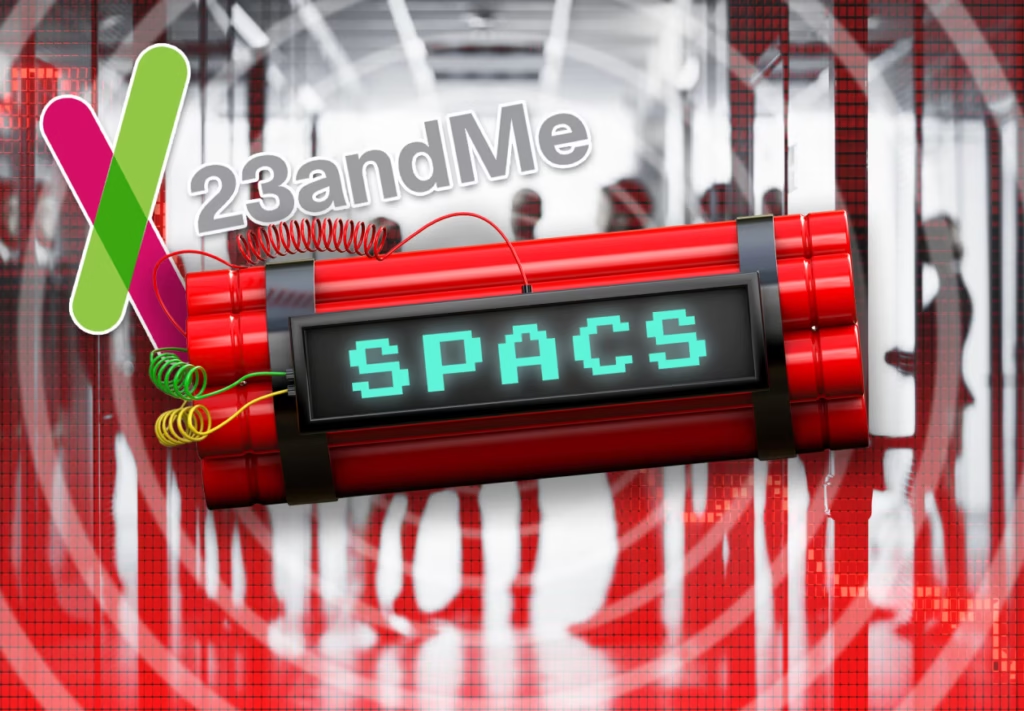

Investing in many of the companies that have gone public through mergers with special-purpose acquisition organizations carries significant risks, as evidenced by 23andMe’s impending bankruptcy.

Businesses that choose to go with traditional IPOs put on roadshows with potential investors who focus on their financials. Executives usually hold off on doing an IPO until their companies are more established because they anticipate that kind of scrutiny.

However, firms have been able to get public-market listings through mergers with SPACs without having to endure the intense scrutiny of the initial public offering (IPO) procedure. A privately held business will choose to combine with an existing blank-check business that specializes in acquisitions. The SPAC then changes its name and ticker symbol to reflect the name of the company it has purchased. Because there were fewer regulations and less strict disclosure criteria, this method used to initially tend to draw higher-risk, early-stage enterprises.

In 2021, 23andMe Holding Co. (ME), a genetics testing company, joined with a SPAC established by British entrepreneur Richard Branson. The company claimed to have a pro-forma cash balance of more than $900 million following the offering, and the deal was valued at $3.5 billion.

As a sign of the financial strains associated with the SPAC procedure, 23andMe had $770 million in cash when it spoke to investors during its June quarter earnings call a few months later. Businesses are required to distribute 20% of their shares to their sponsors.

“The costs are so high,” stated Michael Klausner, a Stanford University Law School professor of business and law who has spent years studying and writing about the dangers of SPACs and their dilutive effects. He went on to say, “The cash out the door is higher than what the underwriters are paid” in a typical initial public offering.

Startups rely heavily on cash, and many public de-SPACs nevertheless function similarly to startups. They also require a significant amount of money, particularly if they are not making a lot of money. Since clients only had to purchase the DNA test kits once, 23andMe’s revenue eventually decreased. Its attempts to diversify into medication development and telemedicine failed to yield significant profits.

23andMe’s September quarter sales was $44 million at the time of their most recent earnings release. Compared to $50 million the previous year and $55 million in the September quarter of 2021, which followed the SPAC merger, that was a decrease. It has $127 million in cash and equivalents as of last November.

It’s been a rough road for investors. Its merger partner’s stock was trading above $266 just before to the closing of the 23andMe SPAC acquisition. Shares now trade for less than a dollar. The remaining board is currently considering selling its enormous collection of genetic information about its customers.

Though they had existed for years, SPACs gained popularity on Wall Street in the immediate aftermath of the pandemic, revitalizing the dormant initial public offering (IPO) industry. SPACs remain prevalent in the U.S. IPO market and gained popularity this year despite warnings and tighter Securities and Exchange Commission regulations, including additional new rules earlier this year that require enhanced disclosures to make them more comparable to traditional IPOs.

As it happens, 23andMe is not the only de-SPAC business to fail. Since 2022, 40 bankruptcies involving companies that went public after merging with blank-check organizations have been tracked by Debtwire’s restructuring database.

“The 2021 frenzy saw funding going to lots of troubled names that, frankly, never should have received this kind of financing in the first place,” Debtwire executive editor John Bringardner emailed MarketWatch.

The majority of the bankruptcies have been Chapter 11 restructurings of distressed businesses, including some well-known messes like WeWork, Bird Global, and Lordstown Motors that managed to resurface as more efficient enterprises. Additionally, he pointed out that two Chapter 7s, or direct liquidations, had occurred at Electric Last Mile Solutions, a commercial EV manufacturer, and Babylon Health, a digital healthcare company.

When the shares of another de-SPAC company fell sharply this week, investors took notice. In addition to reporting a larger annual net loss, nuclear energy business Oklo Inc. (OKLO), which is still without income, informed analysts on Monday that it intends to increase its operating expenditures in 2025 from $38.4 million in 2024 to between $65 million and $80 million. For the week, its stock dropped 17.6%.

Before Microsoft and Amazon started purchasing nuclear power plants to increase their power requirements for AI data centers, Oklo went public in May 2024 in a deal that was first met with disapproval. As internet giants began to favor nuclear energy, Oklo’s shares surged beyond $55 in early February. Since then, its value has rapidly decreased by more than half.

Another issue with SPACs is that, once the blank-check company is established, it must return investor funds and dissolve the business to give investors the appearance that it is a risk-free investment if it does not locate an acquisition target, usually within two years.

Some businesses must redeem investors after failing to identify suitable acquisition targets. Klausner remarked, “Redemption rates are extremely high,” alluding to the procedure whereby blank-check businesses must reimburse investors for their money.

Klausner has written and argued against the massive dilution in SPAC agreements for a long time. Just 14% of the SPACs that merged between 2019 and 2022 were trading above $10, he said in January.

His words, “They won’t go away,” “To my dismay, they are stumbling along, and I’m praying that no actual investors are suffering financial losses. The market, the SEC, and the courts have all issued warnings to them. It’s difficult for them if they still choose to take a chance.