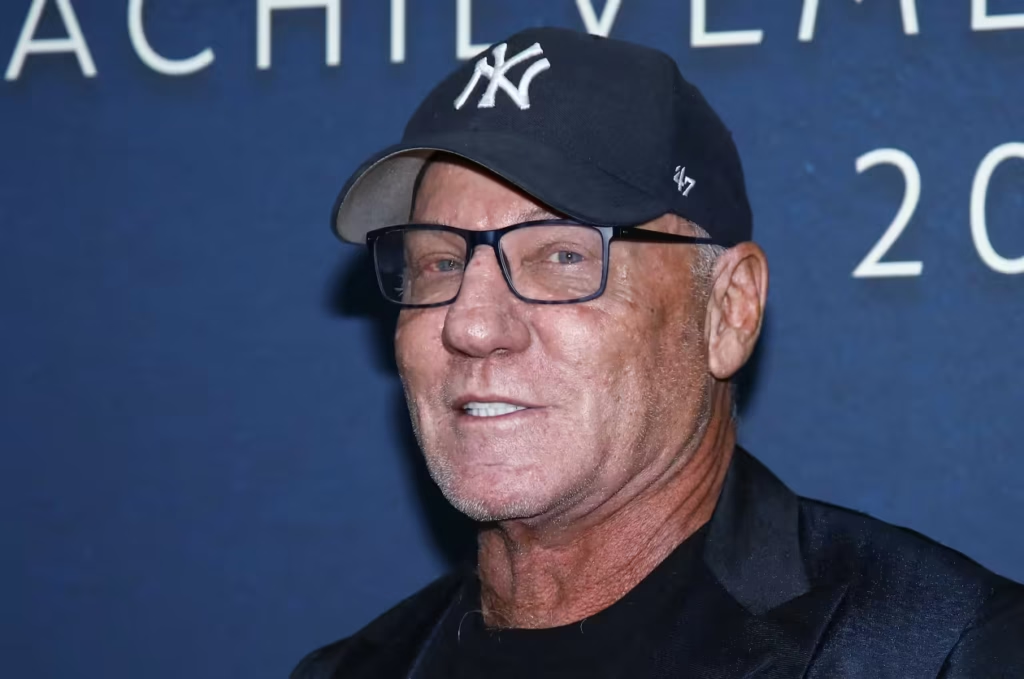

Working a platform has always come naturally to Steve Madden.

In a recent interview on “The Cutting Room Floor” podcast, the founder and former CEO of the footwear company Steve Madden (SHOO), whose platform-heeled boots, sneakers, and sandals became a 1990s fashion staple, criticized President Donald Trump’s China tariffs for driving up shoe prices and “destroying” the American economy.

“We, the Apples, Steve Maddens, Uggs, and Ralph Laurens, are the ones who create commerce.” They’re ruining the economy that we built. Madden, Steve

Podcast host Recho Omandi asked Madden what “the drama” is for him at the moment in a clip generating conversation on TikTok leading up to the Memorial Day shopping weekend. To which he replied: “The tariffs! The shoes are rising. For that, you can thank your government.

According to many sources, Nike (NKE), which produces 18% of its footwear in China and 50% in Vietnam, is also increasing costs by up to 7%.

Madden went on to say that Trump and his followers “fundamentally do not understand what they’re doing.” The US now imposes 30% tariffs on Chinese imports, which was temporarily reduced from 145%.

Please note : Madden uses some strong language in the TikTok below.

Madden pointed out that the tariffs, especially those on Chinese-made goods, are meant to prevent American jobs from being lost to China, which he admitted had already happened.

However, he contended that the relocation of manufacturing and factory employment to China for goods like his shoes or Apple’s (AAPL) iPhones had benefited the American economy by allowing Americans to work at vocations other than “making socks” in factories. The tough border strategy of the Trump administration, Madden continued, is “deporting the people” in America who would want to work in factories.

“The idea is that China has taken our employment. “And because of our relationship with China, we have – but we’ve also picked up other jobs that we would not have had – better jobs, many better jobs,” Madden stated. “Many more than we would have if they [Americans] were in a factory making socks.”

Last year, 71% of the products sold by Madden’s namesake shoe business, which is valued at $1.79 billion, came from China. However, the business announced it would begin shifting production to other nations when Trump was re-elected in November.

Steve Madden then retracted its February financial prediction for 2025 earlier this month, citing “macroeconomic uncertainty related to the impact of new tariffs on goods imported into the United States.”

During the company’s earnings call this month, Steve Madden CEO Edward Rosenfeld stated that discussions with its suppliers had resulted in “meaningful discounts” on goods entering the United States from China. He added that the business has accelerated its attempts to reduce its production dependence on China.

“On previous earnings calls, we disclosed that in 2024, we sourced 71% of our U.S. imports from China,” he stated. “For fall 2025, we expect the comparable figure, excluding Kurt Geiger, to be in the mid-teens and by spring 2026 down to the mid-single digits.”

This month, Steve Madden announced that it had successfully acquired Kurt Geiger, a manufacturer of accessories, purses, and shoes.

White House spokesperson Kush Desai defended the Trump administration’s trade policy after being shown Madden’s interview comments.

“The Trump administration is deploying a multi-faceted approach of tariffs, rapid deregulation, domestic energy production and tax cuts to reshore critical manufacturing and restore American Greatness,” he told MarketWatch via email. “Trillions in historic investment commitments and gross domestic investment spiking by 22% in Q1 2025 prove that this approach is paying off.”

He stated that “Steve Madden should stick to pontificating about pump-and-dump fraud schemes instead of international trade.”

In 2001, Madden entered a guilty plea to securities fraud and money laundering in connection with the Stratton Oakmont “pump-and-dump” financial crisis, which was the subject of Martin Scorsese’s film “The Wolf of Wall Street.” Madden was sentenced to 21/2 years in prison. “I screwed up, I paid my price, and I guess I had to go down that road to get to where I am now,” Madden writes in his 2020 memoir, “The Cobbler.”

Madden also implied in the most recent “Cutting Room Floor” podcast that some wealthy American investors who stand to gain from tariffs are disconnected from the sentiments of consumers and business owners on the potential effects of the trade war.

“I do understand on some level, because there’s a lot of rich people that made money that didn’t build anything, but they made money trading stocks and bonds and buildings,” he stated, adding that he was “not hating” those individuals.

However, they never produced anything. They never had to punch a card, chip a shoe out, or start a business,” he added. “They don’t know what it’s like, and that’s the problem.”

He concluded that section of the podcast by asserting that businesses such as Apple and his own, or rivals in the fashion industry like Ralph Lauren and Ugg, are what are generating economic activity and trade.

“We create the economy, and they’re destroying it,” he stated.

In their comments, a number of listeners endorsed Madden’s claims, stating things like “This is the best PR Steve Madden has ever done for his brand” and “I’ll visit a Steve Madden store.”