The second half and new quarter appear set to begin with modest losses after the S&P 500 SPX and Nasdaq COMP saw two consecutive record-breaking sessions.

Investor tiredness is understandable given the busy, holiday-shortened week and the ongoing battle in the Senate over Trump’s tax and spending bill.

Mark Newton, head of technical strategy at Fundstrat, argues that even though markets may be experiencing a slowdown over Friday’s Independence Day vacation, July is still in favor due to a historically bullish seasonal tendency observed in previous post-election years.

Newton advises investors in a new note that the stock market may simply continue to rise until August, when sideways movement, or consolidation, takes over. With slight technical breakouts by the Dow industrials DJIA and Invesco S&P 500 Equal Weight ETF RSP, he sees indications that the rally is only beginning to spread.

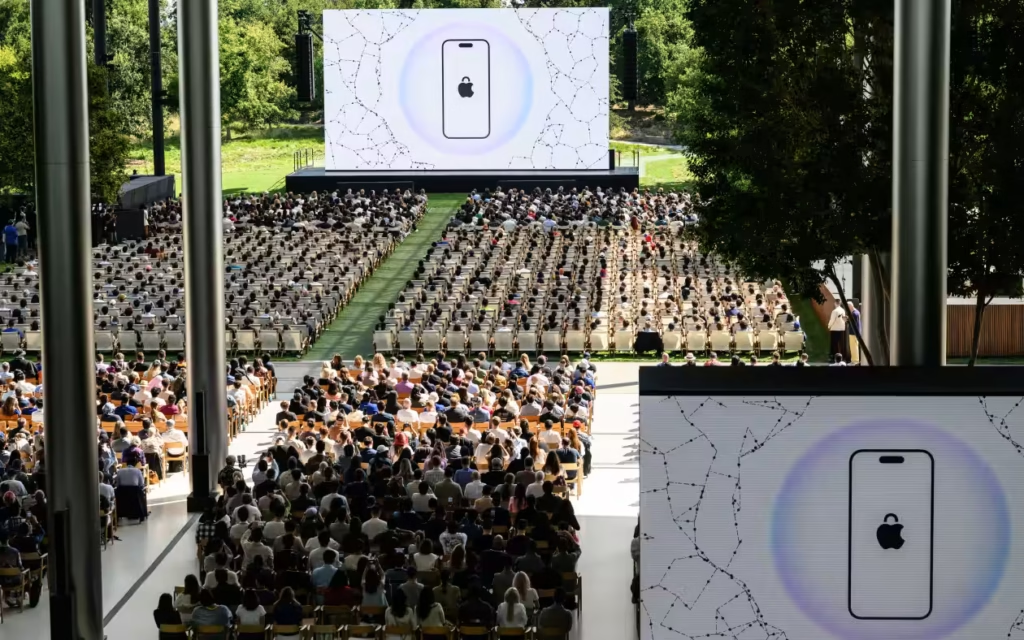

Newton makes a more significant point in our call of the day, highlighting Apple (AAPL) as a key stock to keep an eye on in the upcoming weeks and a role in tech outperformance. That comes after Apple’s behavior on Monday, when it broke out of a month-long phase of consolidation, he added.

This year, Apple has underperformed its key technological competitors, falling 18%; the only company worse off is Tesla (TSLA), which is down 21%. Investors’ concerns about tariff fallout and the lack of advancements in AI have caused the stock of the iPhone manufacturer to plummet in the first half of this year.

Apple shares increased more than 2% on Monday, despite a rising market. Newton attributed that to a rumor that the business is thinking of making a “significant reversal” in strategy by moving away from its in-house technology and utilizing external artificial intelligence to power a new version of Siri. After about a “month of lifeless trading,” he said, the stock finished at multiday highs and at its best closing level since mid-May of little over $205 per share.

Even though it’s only one session, it’s significant as the tech industry prepares for a “challenge of all-time highs versus the S&P 500 in equal-weighted terms.”

Newton said that the S&P 500 had pushed higher by 27% since early April, with Apple barely contributing from mid-May onward. “Overall, it’s essential for Apple to climb above $214 technically to have conviction about a larger rally getting under way,” Newton said.

Tech has experienced some favorable technical moves, and Newton bases its performance evaluation on the Invesco S&P 500 Equal-Weight Technology ETF RSPT. Among them is the recovery of previous lows that date back to 2024 and served as a catalyst for the sector’s upward drive.

Newton expressed his suspicion that a test of technology’s all-time highs could turn into temporary resistance, much like the 2024 lows that were tried functioned as support multiple times before being broken earlier this year.

He stated that the trajectory for tech stocks is as follows: an upswing into August, a stalling out and potential decline into September, and then another push higher into the last quarter of 2025 after that period of stabilization.

Based on a comparison between the Invesco Tech ETF and the Invesco S&P 500 Equal Weight ETF RSP, Newton believes that technology has “come back with a vengeance,” notwithstanding Apple’s sideways trading since May.

“Any ability of Apple to make upward progress heading into July likely could help technology’s recent outperformance continue,” Newton stated.