Boeing Co.’s stock went down on Tuesday after the latest failure in talks to settle the strike by its workers, but the company’s bonds are moving in a different way.

Because of the machinists’ strike over pay on September 13, Boeing’s stock BA -0.78% has gone down. This is because Moody’s Ratings put the aerospace giant’s credit on review for a possible drop.

The strike comes at a tough time for the business, which is trying to fix its production problems and get back on track. This month, the price is down 12%.

Fitch Ratings was also worried about the strike, saying that the company’s grade “has limited headroom for a strike,” especially one that lasts for a long time. At least for now, S&P Global Ratings said it didn’t think the strike would change its grade.

All three credit rating agencies put Boeing’s credit at the very bottom of the investment grade range. It owes $45 billion in debt, and if it were lowered to junk, it would cost more to pay it off. Also, a lot more buyers, like pension funds, who can only buy investment-grade debt would not be able to buy the bonds.

In light of this, it may seem strange that spreads on outstanding bonds have actually gotten smaller since the strike began, even though buyers have been selling a lot of notes with longer terms.

What’s going on then?

CreditSights expert Matt Woodruff said, “The short answer is that it’s the strength of the market.”

The investment-grade market has shrunk by 7 basis points and the high-yield market has shrunk by 15 basis points since the union strike started. He said that’s because the market thinks a “soft landing” for the U.S. economy is now possible after the Federal Reserve cut interest rates by 50 basis points.

“For Boeing in particular, the market thinks it will sell stock after the strike, which could keep the agencies happy with BBB- ratings,” Woodruff said. “However, we don’t think Boeing will be able to give out enough stock to make the agencies happy.”

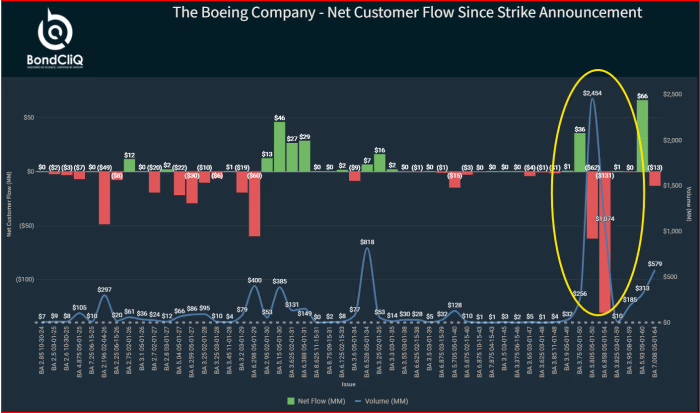

The following charts from data solutions provider BondCliQ Media Services illustrate the trend. The yellow oval highlights the focus on longer-dated bonds.

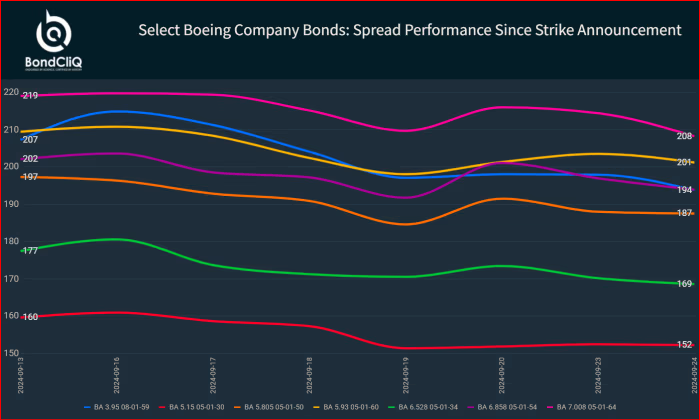

The next chart shows the movement in spreads, which reflects both the strong credit market and the power of recently issued bonds that will pay out more if the credit is downgraded.

Bonds that were issued in May came with built-in coupon step-up features that add 25 basis points to the coupon for each notch of a potential downgrade. If Moody’s and S&P Global Ratings downgrade the credit, holders of those bonds would receive an extra 50 basis points of coupon.

The 3.95% notes that mature in August of 2059 have seen the most tightening, at 13 basis points.

The Associated Press reported that Boeing said it had made its “best and final offer” to the striking machinists on Monday. The offer includes bigger raises and bonuses, but the workers’ union said it wasn’t good enough, and there won’t be a vote to accept it before the end of the week, which is Boeing’s deadline.

The union was upset that Boeing told 33,000 striking workers about its new offers without first talking with union negotiators.

Members of the International Association of Machinists and Aerospace Workers District 751 were told Monday night that Boeing does not get to choose when or if you vote. “The company has refused to meet for further discussion,” Boeing said. “Therefore, we will not be voting” on Friday.

The latest deal is better than the one that was turned down by a large majority earlier this month. It was 30% more than the first offer, according to the company. The pay raises will happen over four years. At first, the union wanted 40% over three years.

Boeing has started putting non-union workers on leave to save money while the strike lasts.

So far this year, the stock has lost 41% of its value, while the S&P 500 SPX 0.15% has gained 20%.