Jimmy Carter has done a lot of amazing things in his life and as president. He won the Nobel Peace Prize, helped make the Camp David Accords, fought for human rights around the world, built homes for Habitat for Humanity, and turned 100 years old.

A big moment is coming up for a lot of Americans, but most of them can’t afford it.

It’s a big deal to reach the triple-digit mark. According to the Carter Center, Carter is spending the day with his family at his simple home in Plains, Ga. He is the only president to have lived to be 100 years old.

American people don’t live that long. According to the Census Bureau, only 101,000 people, or 0.03% of the total, are or were 100 this year. So that number will more than four times grow in the next 30 years, reaching 422,000 people, or 0.1% of the population. Not just for centenarians, but for seniors in general, this growth rate will be much higher than the growth rate of the U.S. population as a whole. In fact, the birth rate in this country is at its lowest level in more than 20 years because people are living longer. The Washington Post says that since 1971, population growth “has generally fallen below replacement level,” which is the number of births that are needed for one generation to replace itself.

In other words, fewer kids born means fewer people will pay taxes for Social Security and Medicare in the future. Still, the number of older people who depend on these huge government programs is growing quickly. Where are you going to get the money? Who is going to pay? Or will the government have to cut back on benefits? That’s the road we’re on, as I’ve said before.

Social Security is a good thing, but it’s only one leg of the three-legged stool that’s meant to pay for our retirement. The other two legs are also not very good, which is a shame.

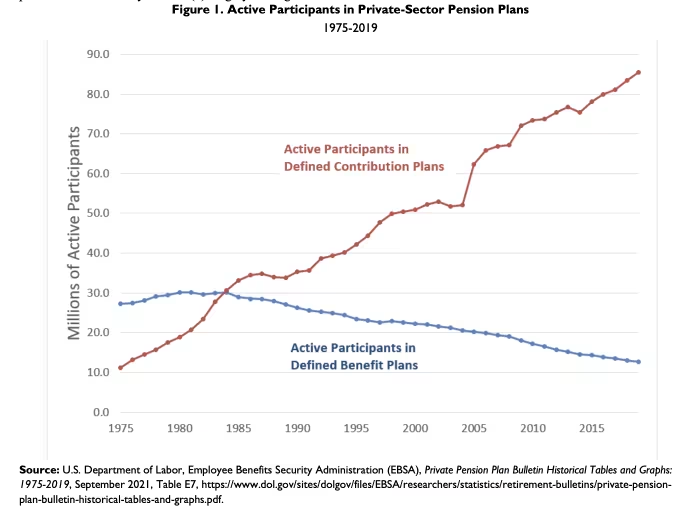

Rent is one leg of the stool. But defined-benefit pensions in the private sector have been going away for decades, leaving most Americans highly reliant on the third leg, which is their own savings. And study after study shows that most people have way too little money saved in 401(k), IRAs, and other accounts.

Just allow me to give you one example. “Can expect to pay approximately $315,000 (after tax) to cover healthcare costs in retirement,” says Fidelity Investments, a big name in the financial world based in Boston. “And that number does not include the cost of long-term care, if needed.”

Still, the Federal Reserve says that the average amount of money saved by American families aged 55 to 64 is $185,000 and the average amount saved by those aged 65 to 74 is $200,000. I’m only talking about how to pay for health care. That’s what I mean by “far too little” when I add in rent, food, etc., and inflation.

They don’t have to worry about money as long as they live to be 100 years old. But most of us do back here in the real world. A new study by the insurance company Allianz found that nearly two-thirds of Americans are more afraid of running out of money than of dying. More than death! It’s hard enough to get older without having to worry about not having enough money. Seriously, that’s very scary.