Troubled chipmaker Intel Corp.’s bonds were getting smashed on Friday as the stock fell to a 50-year low. As the selling sped up, spreads widened by 15 to 20 basis points.

To make things even worse, S&P Global Ratings changed Intel’s A-minus rating to CreditWatch Negative, which means that the company could soon lose its credit ranking.

This is because the rating agency said in a statement that they think the company will likely miss the free cash flow and possible leverage targets that are in line with its current rating. The earnings report from Intel INTC -26.06% late Thursday night shocked investors with a miss on adjusted profit and bad outlook. The company said it would stop paying its bonus, which costs it about $2.2 billion a year, and cut costs by $10 billion. It would also cut staff by 15%.

“Simply put, we need to align our cost structure with our new operating model and change the way we do business in a fundamental way,” CEO Pat Gelsinger told investors. “Our sales haven’t grown as fast as we thought they would, and we haven’t fully benefited from big trends like AI yet.”

S&P said that the steps to cut costs “could alleviate some near-term cash-flow-generation challenges.” But it’s not clear if that will be enough to keep the business competitive and allow it to grow in a good way.

The credit has an A3 rating from Moody’s, down from an A2 rating in February.

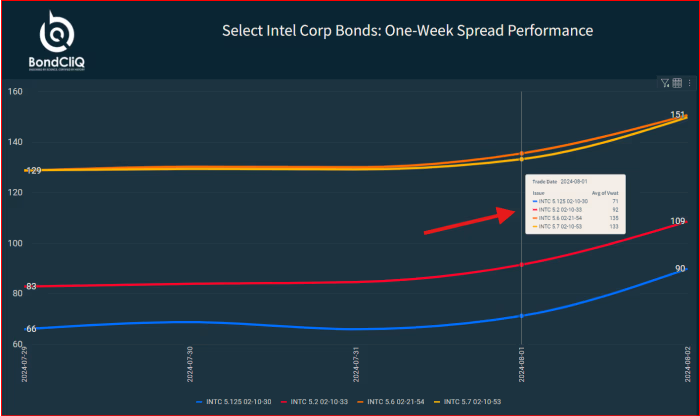

The following charts from BondCliQ Media Solutions, a company that provides data solutions, show how quickly spreads changed overnight. The red arrow separates this trend from the flat performance earlier in the week.

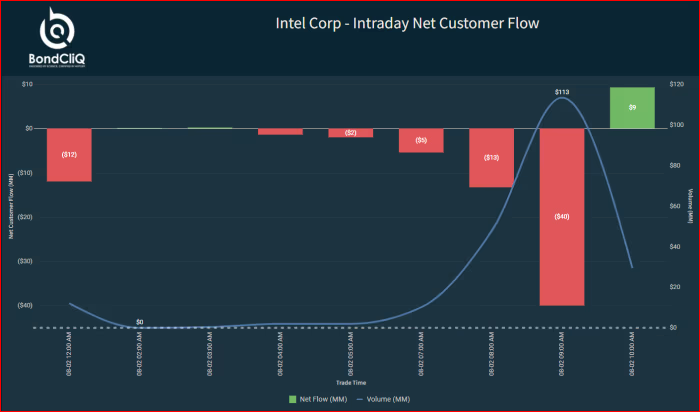

The bonds have seen net selling on Friday with a small set of buyers emerging after 10.00 a.m. Eastern.

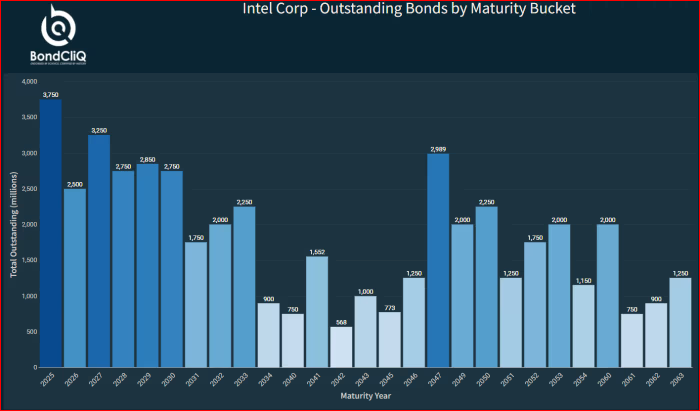

Intel has more than $52 billion worth of bonds, according to FactSet data, with $3.75 billion due to mature in 2025.

The stock, meanwhile, is now down 57% in the year to date, while the S&P 500 SPX-1.84% has gained 12%.