According to Melius analysts, when the market for AI computing and networking hits $2 trillion, Nvidia and Broadcom can both benefit.

Because of Broadcom Inc.’s success in the custom-chip market, some investors in Nvidia Corp. are concerned about new competitors. However, as the market for networking and artificial intelligence computing expands, one expert believes there is potential for both chip businesses to succeed.

During its third-quarter earnings call, Broadcom (AVGO) announced that it had secured a new client for its bespoke silicon, which is anticipated to generate an additional $10 billion in sales in the upcoming year. According to some analysts, this might result in a 100% increase in Broadcom’s AI chip revenue over the next two years, since the company now has four clients ramping their deployments of custom AI chips over the next 12 months. In the wake, Nvidia’s stock (NVDA) dropped about 3% on Friday before rising roughly 1% on Monday.

In a note released on Monday, Melius analysts under the leadership of Ben Reitzes stated that they “have always taken a view that Nvidia’s share of AI compute,” or processing power and computing resources, “would actually fall over time” as custom-chip makers like Broadcom aimed for a market share of about 30%. Application-specific integrated circuits, or ASICs, are specially designed chips for particular AI applications and are manufactured by Broadcom. Graphics processing units are manufactured by Nvidia.

But according to the Melius team, which estimates that by the end of the decade, the market for AI networking and computing might reach $2 trillion yearly, there should be plenty of opportunity for everyone. Both businesses can benefit, according to the analysts.

For its “cadre of loyal developers that use its fully programmable architecture to make real money from AI,” Reitzes likened Nvidia to Apple Inc. (AAPL), alluding to the company’s Compute Unified Device Architecture, or CUDA, ecosystem. According to the analysts, the approach has allowed Nvidia “sustain the vast majority of industry profits,” much like Apple has in the mobile-phone sector, by enabling developers to use GPUs for general-purpose computing.

“Apple’s stock worked long-term (and then some) even as its unit share fell to under 25% globally in touchscreen smartphones,” according to analysts.

According to the Melius analysts, Broadcom’s stock and Nvidia’s “are going a heck of a lot higher,” even if Nvidia’s market share drops to 40%, assuming it can capture 20% of the $2 trillion total addressable market they are forecasting by 2030.

According to experts, Nvidia’s current second-half run rate reflects its position of over 70% of the total addressable market for computing, networking, and artificial intelligence, which is expected to reach $300 billion this year.

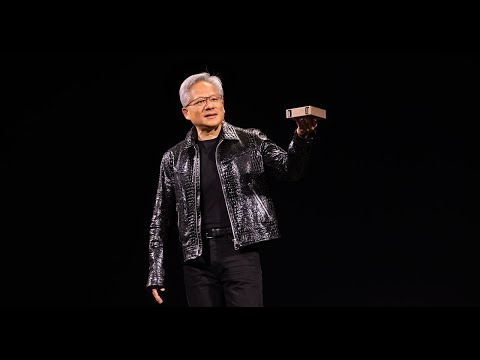

Analysts stated that Nvidia CEO Jensen Huang “must see something in his upcoming orders that is really good” following the company’s second-quarter capital expenditures data, which “were higher than expected and forecasted to go higher too.”

In the meantime, OpenAI, which analysts believe may be Broadcom’s fourth unnamed client, recently informed investors that it anticipates spending $115 billion through 2029—much more than the $35 billion it had previously projected.

That indicates to the Melius team that OpenAI “intends to raise – and spend a lot more money on compute and networking from many sources.”

However, Citi Research analysts are a little less optimistic than they were previously, lowering their price objective for Nvidia from $210 to $200 due to the heightened rivalry, which they believe is caused by Alphabet Inc.’s (GOOGL) (GOOG) attempts to provide computational power to its competitors.